Where To Register A Business In Maryland

How to Showtime a Business organisation in Maryland:

In that location are several ways to showtime a business in Maryland. You can either grade a sole proprietorship or general partnership which are non legal entities but must nevertheless be reported to the land and comply with licensing and tax requirements, or you can opt to form a legal entity, such as a corporation or LLC, that provides you lot protection from liabilities. Most businesses can be conveniently registered online, including applications for licenses and tax accounts.

1.1

Review Maryland formation options.

Maryland offers four master ways of forming your business organization. Review these closely and pick the one that fits your business concern best.

Once you have decided on a business proper noun, enquiry the name to ensure that it is available for yous to utilise and does not infringe on another business'south name.

- Search Google to come across if anyone is using the name.

- Check the United States Patent and Trademark Office (USPTO) trademark database.

- Perform a business entity search on the Maryland Business Limited site.

In one case you have verified that the proper noun is available, yous can file a trademark application through the Maryland Business Express portal or use for a corporate name reservation.

Complete and sign the form.

Submit the application along with a $25.00 filing fee to the Maryland Land Section of Assessments and Revenue enhancement.

The proper name reservation is valid for 30 days.

1.3

Annals a trade proper name.

If you lot are forming a sole proprietorship or partnership and want to operate under a name that differs from the full legal name of the business possessor(s), y'all must register a trade proper name. Legal concern entities must annals a trade name if they intend to operate under a name that differs from the business's legal name.

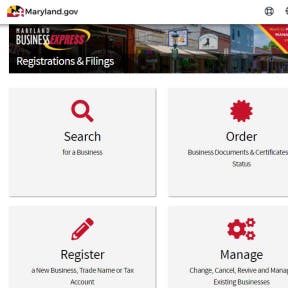

Create an business relationship and log in.

Select "Offset a New Filing" in the "Online Filings" tab and select "New Business Filings" in the drop-downwardly carte du jour.

Click "Register a New Merchandise Name" in the drop-down menu.

Read the instructions and click "Proceed to Register Merchandise Name" in the bottom right corner of the page.

Follow the prompts and complete the required information.

Submit the application and pay a $25.00 filing fee.

i.five

Register your business organization in Maryland.

When yous create your business concern structure in Maryland, you register your concern name every bit well. You can download the relevant awarding forms from the SDAT website and file the completed application with the Maryland State Section of Assessments and Taxation, Charter Sectionalisation either by postal service or in-person, along with the applicable filing fee.

With the exception of articles of incorporation for nonstock corporations and document of limited liability partnership, you can file all business formation documents online through the Maryland Business Express portal.

Once you're on the Maryland Business organization Express login folio, sign in and select the tab "Online Filings."

Click on "Start A New Filing" and select "Annals a Business" in the driblet down bill of fare.

Select the business blazon you wish to register.

Follow the prompts and consummate the online application.

Verify that all the data you take entered is correct, submit the awarding and pay the applicative filing fee.

While there are no legal entry formalities for sole proprietorships and full general partnerships, they must complete and submit an application for identification number upon which it volition be determined whether the business needs an identification number.

1.6

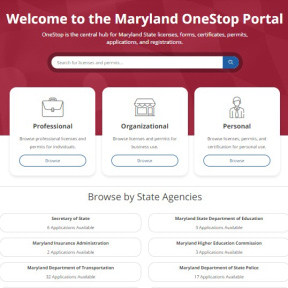

Obtain necessary licenses and permits.

Most businesses, including retailers and wholesalers, are required past police force to have a Maryland business license. Your local clerk of the courtroom can advise you on licensing requirements, and you can also get data from your county's office on inspections, licenses, or permits.

If your business buys and resells appurtenances, you are required to have a trader's license. Depending on the nature of your business concern, y'all and your employees may likewise need professional and occupational licenses.

Visit the Maryland OneStop website and select "Browse" in the "Organizational" box or select the relevant category under the heading "Scan by Country Agencies."

Side by side, you will find a listing of entries that display the title of the license or permit, a brief clarification, the application fee, and the estimated time for approval.

Browse the directory of licenses and permits or enter a keyword to find a relevant entry.

Select the license or permit you need and read the step-by-step instructions provided. Beneath the instruction, yous will have the option to select "Utilize Now" to start your online awarding.

Follow the awarding instructions, download and complete the required forms, submit the awarding and any required documentation, and pay the fee.

If you have any questions regarding the license or application procedure, you can accomplish out to the responsible bureau using the contact information provided on the bottom of the page.

2.

Register your business organization for taxes.

two.ane

Prepare Maryland tax and insurance accounts.

To annals for tax and insurance accounts with the comptroller of Maryland, visit the comptroller's local offices or the website to obtain a Combined Registration Application (CRA) form. When completing this application, select all the tax and insurance accounts y'all need to register, such equally a sales and tax use license, an employer's withholding tax account, and an unemployment insurance account.

You tin also complete this awarding online through the Maryland taxes interactive web services portal.

Sign in to your Maryland Business organization Express account and click "Start A New Filing" in the "Online Filings" tab.

Select "Register Tax Accounts with Comptroller" in the driblet-downwardly menu.

Select "New Business concern" as the reason for the awarding.

Follow the prompts and enter the required information most your business.

Select the licenses and tax accounts you want to register.

Enter you contact data and verify that all the information you provided is correct.

Consummate and submit the application.

ii.two

Apply for a Maryland sales and utilize tax business relationship.

If your business makes sales or provides taxable services in Maryland, y'all must have a sales and use license.

Obtain a Combined Registration Application (CRA) from the Comptroller of Maryland's local offices or website.

Complete section A and bank check the relevant box (a.) nether betoken 8.

Respond all questions in all the other sections that pertain to your business.

Complete section F and sign the form.

Post the completed awarding to the address provided on the class.

2.three

Apply for an employer'south withholding revenue enhancement account.

Employers paying salaries, wages, or compensation to individuals are required to have an employer's withholding revenue enhancement account.

Get a Combined Registration Application (CRA) form from the Comptroller of Maryland'southward local offices or download information technology from the website.

Complete section A and check the relevant box (eastward.) under point eight.

Answer all questions in all the other sections that pertain to your concern.

Consummate section F and sign the class.

Mail the completed awarding to the address provided on the form.

2.iv

Apply for an unemployment insurance account.

In Maryland, industrial and commercial employers, as well as many nonprofit businesses, are subject to the state unemployment insurance constabulary and must register an unemployment insurance account.

Obtain a Combined Registration Application (CRA) class available from the Comptroller of Maryland's local offices or from the Maryland taxes website.

Complete sections A and B.

Respond all questions in all the other sections that pertain to your business.

Consummate section F and sign the form.

Mail the completed application to the accost provided on the course.

3.

Register employees with the state and become insurance.

3.i

Report new employees to the country.

If you hire or re-hire employees for your business in Maryland, you lot are required past federal and state police to study them within 20 days to the Maryland Country Directory of New Hires Reporting.

You can report new hires by completing a new rent report bachelor on the employer services portal and mailing it to the Maryland Country Directory of New Hires (the accost is provided on the course) or by using an online form. To access the online resources you will accept to create a user business relationship.

Create a user business relationship on the Maryland Country Directory of New Hires website and log in.

Click "Written report New Hires."

Yous will be directed to the new hire report online form.

Enter the required data.

Y'all tin can view the reports you lot take submitted in the "View Pending" section until they accept been fully processed.

three.2

Obtain mandatory insurance.

In Maryland, workers' compensation insurance is mandatory. If your business organisation fails to comply, you are discipline to a fine of up to $x,000.

Maryland is also a mandatory vehicle insurance country. If your business uses vehicles, you are required by law to be covered with liability insurance through a vehicle insurance company licensed in Maryland.

Maryland Concern Types:

1. Sole Proprietorship.

A Maryland sole proprietorship is the simplest concern construction you can cull. The business organisation is not a legal entity and in that location is no distinction between the business and its owner, which means its possessor is liable for its debts and losses. In Maryland, sole proprietorships must submit an awarding for identification number with the SDAT.

2. General Partnership.

A general partnership is similar to a sole proprietorship but has more one possessor. It is non a separate legal entity and therefore owners are not protected from liability. They must also submit an application for identification number with SDAT for their need thereof to be determined.

3. Express Liability Company.

Maryland limited liability companies are legal entities with a structure like to a partnership and are taxed the same way as a partnership, but offering the same liability protection for its owners, referred to equally members, as a corporation. Observe out how to start an LLC in Maryland.

iv. Corporation.

Maryland corporations are separate legal entities and are owned by shareholders who must elect at to the lowest degree 3 officers (a president, a secretarial assistant, and a treasurer) and i manager to run the business. Corporations afford shareholders protection from liabilities simply are subject field to double taxation.

Where To Register A Business In Maryland,

Source: https://www.namesnack.com/guides/how-to-start-a-business-in-maryland

Posted by: johnsondeprectuod.blogspot.com

0 Response to "Where To Register A Business In Maryland"

Post a Comment